07 Oct Global warming, is money burning ?

Cet été 2022 aura été incendiaire. Les épisodes caniculaires, les incendies et enfin l’inflation ! Les feuilletons de l’été se sont enchaînés.

L’inflation est un sujet brûlant suscitant de nombreux débats. C’est un phénomène qui touche tout le monde (Gouvernements, Acteurs Financiers, Entreprises, Ménages…). L’inflation affecte les décisions d’achat, d’investissement et l’économie dans son ensemble. L’impact n’est pas le même pour tout le monde, chacun la percevant et la vivant différemment. La définition même du concept peut prêter à confusion.

Afin de vous accompagner dans votre réflexion, vous trouverez ci-dessous un point de vue pour mieux appréhender cette dernière et comprendre les controverses d’aujourd’hui.

Il y a un peu plus d’un an, le niveau d’inflation était bas. Le sujet intéressait principalement quelques professionnels. En réalité, le niveau d’inflation et les taux d’intérêts furent bas, durant une décennie environ, en « Occident ». Il y a également eu le grand soutien à nos économies durant la crise du covid via des programmes de dépenses publiques, et ce, sans inflation dans un premier temps, ce qui a pu suscité l’interrogation au sein des milieux économiques et financiers.

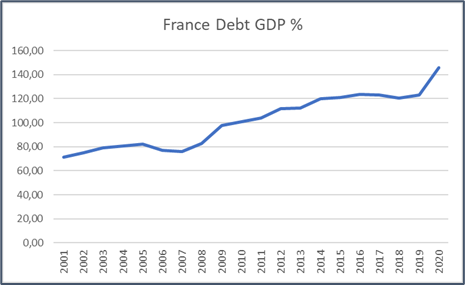

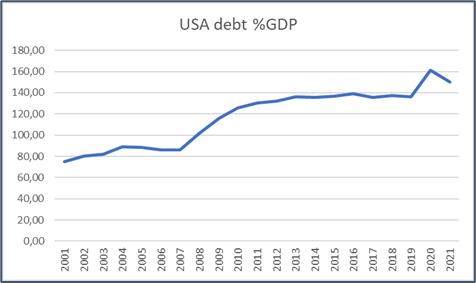

Plus en amont, les nombreux débats sur les mesures d’austérité ou sur la possibilité d’injecter massivement de l’argent au sein des Economies, donnent naissance à la MMT (Modern Monetary Theory), remettant en cause les théories classiques.

L’inflation interrogeait par son absence.

Ce papier vous propose de se rappeler comment les acteurs économiques ont fait évoluer leur point de vue au cours de ces 15 derniers mois.

La menace de l’inflation a progressivement pris place dans les esprits. La hausse de l’inflation était vue comme un phénomène transitoire, temporaire. Puis il fallut se résoudre à une réalité qui s’est installée durablement semble-t-il, et qui ne cesse de croître.

Aujourd’hui l’inflation est bel et bien là, sur toute la planète sans exception et à un niveau particulièrement élevé.

Afin de mieux comprendre la situation actuelle, il est intéressant de regarder les anticipations d’hier. La complexité, les biais cognitifs, les différences entre pays et devises peuvent être des éléments à considérer pour comprendre les erreurs commises.

Global warming, is money burning ?

One year ago, Inflation was already puzzling. The puzzle was different. We were at the end of the 2010’s paradox, a decade where inflation was more or less stable and challenging economic theory. There were debates about the policy responses made after the 2008’s financial crisis and, again, throughout the Covid Crisis. Large amount of public money was spent to soften the situation and ensure that corporations and household could withstand these moment. Economists expected that such actions would and should lead to inflation. However, the last decade show little of it, despite quantitative easing and extremely low interest rates. I remember attending a meeting of French asset and liability manager in April 2021, the hot topic was MMT (modern monetary theory). Inflation was then seen to be less connected with expansionary policies than before. But the last year witnessed Growth coming back, with it Inflation pressures and now inflation levels hit records after records.

To have a better understanding of the debates and of today’s situation, we will take a one year journey. But first of all let’s remind us what’s inflation then we’ll see how did we face the questions raised about it over go last year.

Inflation is there, it is now a hot topic in the US and Europe. Last figure show a level of 5.3% of inflation in France over the last year and people witness increase in prices month after month. How did we get there after a decade where inflation was puzzling but not really worrying ?

Inflation : What do we talk about ?

The definition :

Inflation can be seen through different lens and felt differently by each one. As noted by the ECB, the main idea is an increase in prices. More precisely, it must concern many items and on average 1 unit of money is worth less :

“Broad increase in prices. In a market economy, prices for goods and services can always change. Some prices rise; some prices fall. Inflation occurs if there is a broad increase in the prices of goods and services, not just of individual items; it means, you can buy less for €1 today than you could yesterday. In other words, inflation reduces the value of the currency over time.”[i]

An increase in prices affects the value of money. But how prices of different goods and services should be considered? Not everyone has the same consumption of goods and services. An increase of the cigarette’s prices will not affect everyone, same for gasoline or gaz. Moreover, how do you consider the increase in cellphone prices when these devices replace cameras and their quality increases? Tacking account of all those aspects, of new and old habits, is the objectives of a good measure, but none could be perfect. That’s why we can rely on different metrics.

The measures

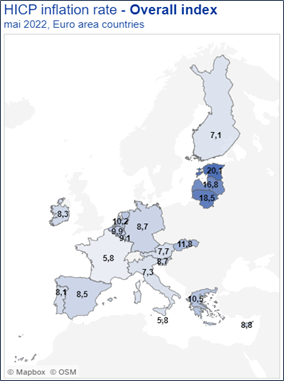

Relying on a measure matters. It always helps to have a number. It is especially useful in driving the decision making process. Inflation figures are used by households, governments, financial actors, in the fixing of some contracts, etc… For one monetary area, the central bank need one common measure. In Europe, the HICP (Harmonized index of consumer prices) is the reference. It is based over a set of 700 goods and services (known as the consumption basket). This is a standard methodology. The set is not define for eternity. One example of recent evolution is the integration of home ownership into the calculation. This measure is used by the European Central Bank to define its monetary policy.[ii]

Other approaches are also used : the deflation of consumption, deflation of the GDP, a focus over some part of the population (inflation for a specific decile per example). Each country also uses an ICP which is closed to the one used by the ECB but specific to its economy (for example, INSEE in France measures inflation at 5.2% against 5.8% for the ECB in May 2022). One can see that inflation in Europe is heterogenous (see box[iii]). One can also focus on inflation from imported goods or over some industrial sectors, such as index of production prices, to understand where inflation may come from. For the purpose of this paper we focus on HICP.

https://www.economie.gouv.fr/facileco/livret-a-taux-calcul

Where do inflation come from ?

Inflation may come from monetary policy or government spending (demand side). To put it simple, if you double the amount of money, everything else being equal in an economy, you’ll double the prices (real purchasing power will not change). When a central bank defines its rates policy, it affects the amount of money created (to be noted : a central bank has other tools than rates). The same with government spending, an increase will make “more” money available to agents.

Inflation may also come from abroad or from production costs (supply side). It can be imported if you need goods or services that becomes more expensive. So commodities and exchange rates matters also. It can also come from a pressure on salary (low unemployment can lead to inflation in theory – aka the Philipps curve).

One should look at different actors of the economy when discussing the subject (supply side as well as demand).

Why do Inflation matters ?

Inflation matters. When inflation is high, purchasing power and growth are impacted. There is a risk of a drop in confident, and a creation of a vicious circle. The economy could become unmanageable. Across history, we’ve seen problems raised by high level of inflation in some countries (Germany in the 1930’s, Argentina more recently and many other). Purchasing power diminishes as salary can’t follow as quickly, which in turns impede consumption. Investors ask for higher return (taking into account the real interest rates, i.e. the difference between rates and inflation). This could reduce investment and consumption leading an economy towards recession. Moreover all those factors could foster a bigger inflation in a second round effect.

Stability in prices helps investors and households to make better decision. Uncertainty is the enemy. A deflation (decrease in prices) is also an issue, it induces economics’ agent to delay their buying actions. That’s why there is a consensus that a certain level of inflation is a good thing. It indicates a good use of the economy resources. It helps to build a long term vision, to build a good balance between savings and investments and a stability of exchange rates also. For the central bank, It’s its mandate is to enhance a policy that offers a stability of prices. A common target is to set the inflation below, but close, to 2% yearly (There’s been debate about this number, Olivier Blanchard argued for a higher target, for the purpose of this paper we’ll not discuss the quality of this number).

What happened between year 2000 and 2020 ?

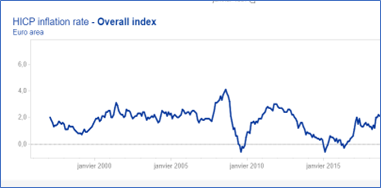

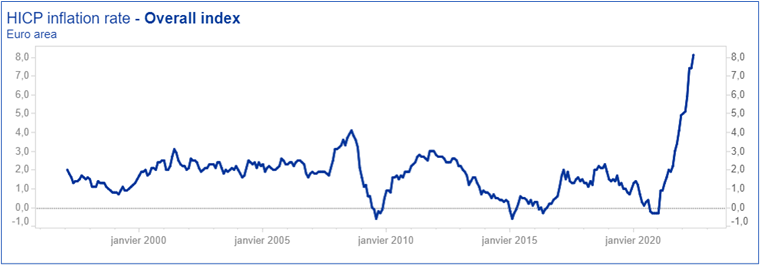

In Europe, since the Euro was the single currency, inflation stayed steady. During the 2008 financial crisis, we witnessed a temporary increase that didn’t last. It was followed by a very short episode of deflation which didn’t last neither. Overall, the inflation rate was well around the target (close but below 2%). That should be seen as a good thing and normal as it is the objective of the central bank.

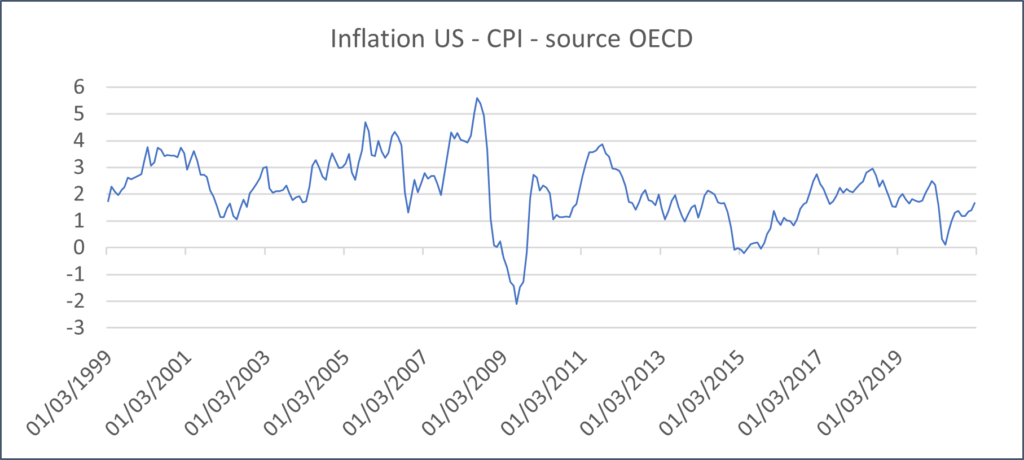

The situation was similar in the United States, even though it’s average level was a bit higher than in the Euro area.

After the 2008 financial crisis, large amount of public money was spent to ensure the functioning of the financial sector. Interest rates stayed low for a long period. Unemployment went low in the US without a surge in prices. At first, austerity was recommend to manage the debt and avoid inflation and a raise in real interest rates. But eventually, inflation level remained controlled despite the monetary policy and public spending, this period raised interrogations among economists and policymaker.

The aftermath of the financial crisis, austerity, quantitative easing, MMT and approach towards inflation

The last year witness inflation and debates coming back. Why all this fuss about it ?

Interrogations started to come at the beginning of the 2021 summer, after what for a year we’ve been witnessing a growing interest towards inflation.

- In June 2021:

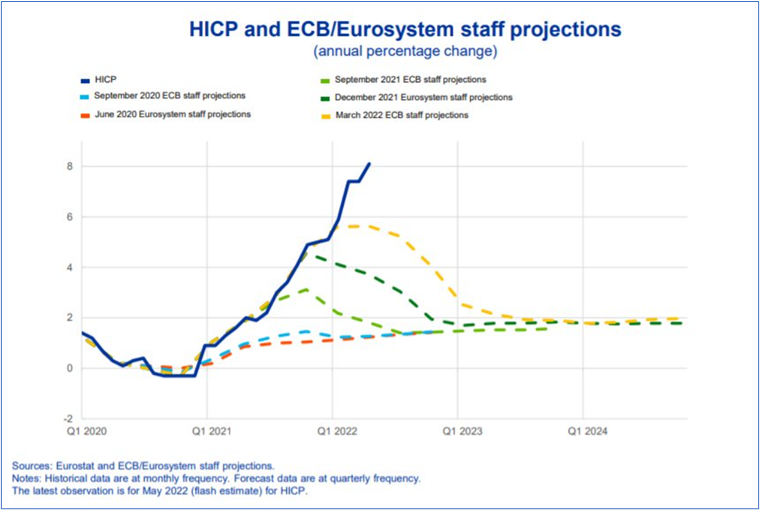

Increase in prices was there for a few consecutive months, as noted by the white house economic counsel[vii]. There was a pattern with a continuous increase over the first semester. But, as mentioned in their communication, the roots and the magnitude of the phenomenon deserved to be investigated. In Europe, the ECB updated its inflation forecast. It anticipated a small increase with a level of inflation below 2% for 2022 and 2023 (spoiler alert, they were wrong). The forecast of the Banque de France remained even lower for the country, but their report highlighted that uncertainty towards inflation was raising[viii].

https://www.lefigaro.fr/conjoncture/croissance-et-inflation-la-bce-releve-ses-previsions-pour-2021-et-2022-20210610

- In July 2021 :

In an economic note, Natixis warned about an inflation risk. Their argumentation was based upon classical economic theory. In the OECD, Governments have maintain household income despite a drop in the GDP, part of it has been saved, as we can see in France with an amount estimated at 140 G€[ix]. They warned that when reinjected into the economy, this amount of money could raise demand and creates inflation[x].

- In August 2021 :

There was a feeling that the worst was behind and high level of inflation would be temporary. That was the understanding of Wall Street after a slower increase of inflation in the July figures[xi]. The dynamic was a bit weaker but still there. When looking over different type of indicators, it seemed that inflation had its root coming from the supply side. Cost of production were rising because of a shortage of commodity, a lack of workers in some sectors. All this led the authorities to interpret it as a short time issue as full employment wasn’t there (could also have been some kind of wistful thinking). This theory gained some weight with the numbers in France where inflation decreased in July[xii].

Governments felt confident that the situation would go back to normal. The main priority was to ensure the recovery from the pandemic. Inflation was thought as something that would vanish. Per example, at Jackson Hole, the Fed chair indicates that inflation was due to short term factors and shouldn’t last as long term expectations of inflation showed[xiii]. But as said by Ricardo Reis : what actions are taken to ensure that inflation will remain stable?[xiv]. Unfortunately, worries didn’t disappeared and inflation still continued its ride.

- In September 2021 :

Worries about the level of monetary creation and inflation in the US showed up[xv], the WSJ asks questions about the target of inflation. When disentangling inflation, the OCDE pointed out a raise in energy prices; Its impact and the dynamic of inflation remained different between Europe where inflation was at 2,2% in the USA where the number was 5,4% [xvi]. This level of inflation started to raise questions and doubts about whether it would last[xvii].

- In October 2021

The shift from a long period of inflation under control to worries started to look clear. In October, the level of inflation in France went over 2% and The economist asked if were going through the 70’s again[xviii] In October, the French economy minister Bruno Lemaire warned about inflation, but was focus over energy prices.

- In November 2021

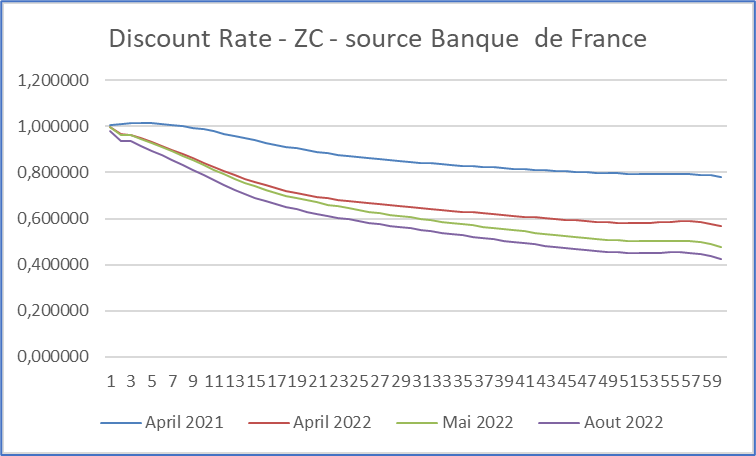

In November, Inflation was there in Germany also and warnings appear about a growth rate lower than expected over next years. In November Joe Biden talks about the concerns regarding inflation, it is a priority to change the curve, he argued[xix]. Financial markets started to worry about the level of interest rates, which can be seen in the shift from the zero coupon curve (see graph below). The monetarist theories gained more weight in the public debate as underlined in LeMonde[xx].

It was then clear that inflation was a real thing of the last semester of 2021 and would still be a bit of something in 2022. But there was more to come.

- From February 2022 till today

In February, Olivier Blanchard was reassuring over inflation in France. The European Central Bank stated that it does not want to rush into any bold actions. In May 2022, LeFigaro relates fears about stagflation[xxi], and the French economy minister insists that it is his duty to protect households against inflation. Next graph shows that the last year have seen both a large adjustment from forecast with unusual errors and a high level inflation settling the pace. [xxii]

It has to be noted that financial markets reacted in a similar path also. If we look at the discount factor from zero coupon, we can look at their forecast of inflation, and we’ve witness a shift from last year.

A few last words

As time goes, mindset changes. In one year, we went from modern monetary theory to worries about lasting inflation and stagflation. As said by an economic note from Natixis in May 2022, the good question might not be why inflation is there now but why it wasn’t there before, during the 2010’s ?

Forecast have been wrong, mistakes have been made, and will be made again. Economic science is evolving. A recent paper from the Banque de France talks about new indicators to follow underlying inflation[xxiii].

To better understand the future, we need to understand what happened. First, there was plenty of factors pointing towards temporary inflation :

- A saving surplus during the crisis ;

- Temporary tensions over energy prices (which lasts, partly due to the war in Ukraine) ;

- A catch up from the pandemic ;

- Tensions in shipping that were hoping to loosen with the recovery from the pandemic and because of the vaccines ;

If someone could perfectly forecast inflation, the guy would be rich and would not be writing about it. What we learned from the last decades and last year about inflation is that we need humility. Maybe we’ve been prone to cognitive bias :

- Overconfidence : Inflation hasn’t been there for a decade, it won’t be a problem.

- Confirmation bias : some people were focusing over indicators that were reassuring their positions.

- Anchor : After mixed signals, people stayed on their first feelings/thoughts.

Today, I think most indicators point in the direction of a steady level of inflation higher than the usual target of 2% annually. Level of employment, energy and commodity prices, wages, trade wars, all of this makes me think that after a ten year of stable low inflation, we’ll see something different.

The remaining questions might be who are the winner and the losers? Is there a big difference the US and Europe in terms of dynamic? Olivier Blanchard believes that U.S. inflation is driven more by demand than supply, while in Europe it’s the opposite[xxiv]. The question of financing the transition towards low-carbon economies could also lead to maintain an accommodated monetary policy, as raised by Alain Grandjean[xxv]. And how central bank can react without impeding growth and a decline in asset prices ? The ECB recently acted. The first increase since a long time, even though rates remain quite low.

Références

[i] https://www.ecb.europa.eu/ecb/educational/hicp/html/index.fr.html

[ii] https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.fr.html

[iii] https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html

[iv] A Skeptic’s Guide to Modern Monetary Theory

[v] M. Reinhart et Kenneth Rogoff ont montré que ce n’est que lorsque la dette publique dépasse 90 % du PIB que les effets sur la croissance deviennent négatifs, et même fortement négatifs. Très critiqué (peu de pays justifiant la démonstration, confusion entre corrélation et causalité, etc.), leur travail vient de faire l’objet d’une remise en cause importante par Alexandru Minea et Antoine Parent : https://www.cairn.info/revue-l-economie-politique-2012-3-page-5.html

[vi] https://www.morganstanley.com/im/publication/insights/investment-insights/ii_bewaremodernmonetarytheory_en.pdf

[vii] https://twitter.com/WhiteHouseCEA/status/1414940727088402438

[viii] https://publications.banque-france.fr/projections-macroeconomiques-juin-2021

[ix] https://www.lefigaro.fr/conjoncture/pendant-la-pandemie-les-francais-ont-epargne-142-milliards-d-euros-de-plus-que-d-habitude-20210601

[x] https://www.research.natixis.com/Site/en/publication/jIt4dprzDZQl4WSbzxCkKb_Gwt2mTck5nzSdc2gPJ78%3D?from=email

[xi] https://www.lemonde.fr/economie/article/2021/08/12/aux-etats-unis-l-inflation-reste-elevee-mais-decelere_6091247_3234.html

[xii] https://www.lefigaro.fr/flash-eco/l-inflation-decelere-a-1-2-sur-un-an-en-juillet-confirme-l-insee-20210813

[xiii] https://www.ft.com/content/ced45222-f266-4d48-b754-e960e8581c94

[xiv] https://twitter.com/R2Rsquared/status/1431656639237611522

[xv] https://www.lemonde.fr/idees/article/2021/09/14/le-grand-retour-du-spectre-de-l-inflation_6094562_3232.html

[xvi] https://www.oecd.org/fr/sdd/prix-ppa/consumer-prices-oecd-09-2021-Fr.pdf

[xvii] https://www.economist.com/finance-and-economics/americas-consumer-price-inflation-stays-above-5-in-august/21804762

[xviii] https://www.economist.com/finance-and-economics/

[xix] https://www.lefigaro.fr/flash-eco/pour-joe-biden-inverser-la-tendance-de-l-inflation-est-une-priorite-absolue-20211110

[xx] https://www.lemonde.fr/idees/article/2021/11/05/en-2022-nous-risquons-d-entrer-dans-une-periode-de-forte-incertitude-avec-un-mur-d-inflation-et-une-croissance-en-baisse_6101068_3232.html

[xxi] https://www.lefigaro.fr/conjoncture/qu-est-ce-que-la-stagflation-cette-menace-qui-plane-sur-la-france-et-la-zone-euro-20220508

[xxii] https://www.lefigaro.fr/flash-eco/france-l-inflation-accelere-a-5-2-sur-un-an-en-mai-20220531

[xxiii] https://publications.banque-france.fr/un-nouvel-indicateur-possible-pour-mesurer-linflation-sous-jacente-en-zone-euro

[xxiv] https://noahpinion.substack.com/p/video-interview-olivier-blanchard

[xxv] https://www.lemonde.fr/idees/article/2022/05/06/alain-grandjean-hausse-des-taux-et-politiques-de-rigueur-penaliseraient-la-transition-ecologique_6125030_3232.html